By following these steps, you can improve your odds of approval and work toward better financial health.

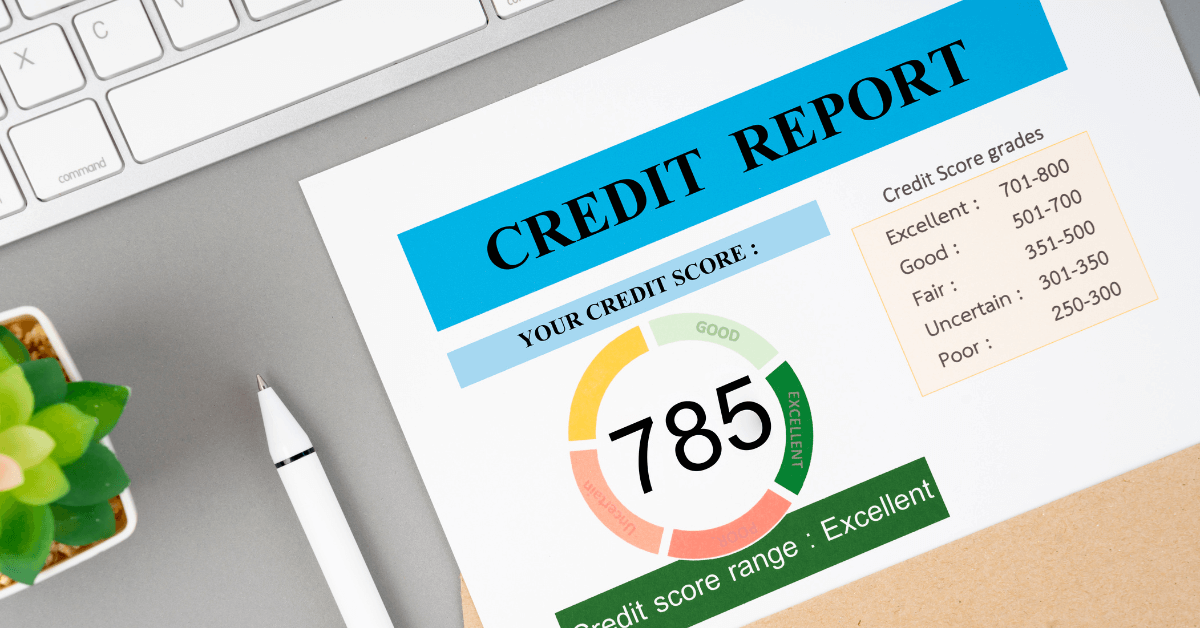

Check Your Credit Report

Before applying for a credit card, review your credit report to understand your current financial standing. Look for any errors, such as incorrect account information or late payments that you didn’t make. If you find mistakes, dispute them with the credit bureau. Keeping your credit report accurate can make a difference in your approval chances.

Understand Your Credit Score

Lenders use your credit score to decide whether to approve your application. If your score is low, you might not qualify for standard credit cards, but you may still be eligible for secured or credit-builder cards. Understanding where you stand can help you apply for the right type of card.

Choose the Right Type of Credit Card

If you have bad credit, you may not qualify for premium rewards cards, low interest credit cards, or interest free credit cards. Instead, look for credit cards specifically designed for people with bad credit. Options include:

-

Secured credit cards: Require a cash deposit as collateral.

-

Credit-builder cards: Designed to help improve credit with responsible use.

-

Retail store credit cards: Easier to qualify for but may have high interest rates.

Compare Your Options Before Applying

Applying for multiple credit cards at once can hurt your credit score. Instead of applying blindly, compare different options to find the best fit.

Look at factors like annual fees, interest rates, and credit limits. Some lenders even allow you to check if you’re prequalified before submitting a formal application.

Apply for Prequalification

Many credit card issuers offer prequalification, which allows you to see if you’re likely to be approved before you formally apply.

Prequalification typically involves a soft credit check, which doesn’t impact your score. While prequalification doesn’t guarantee approval, it helps you avoid unnecessary hard inquiries on your credit report.

Limit Your Applications

Every time you apply for a credit card, the lender performs a hard inquiry on your credit report, which can slightly lower your score.

Too many hard inquiries within a short period can make it harder to get approved. To minimize the impact, only apply for one card at a time and wait to see if you’re approved before trying another.

Consider a Co-Signer or Authorized User Option

If you have a trusted friend or family member with good credit, they may be willing to co-sign for a credit card or add you as an authorized user on their account.

A co-signer shares responsibility for the card, while being an authorized user allows you to benefit from their positive credit history. Both options can help you get approved and build credit.

Show Proof of Stable Income

Credit card issuers want to ensure you can repay your debts. Having a steady income improves your chances of approval.

When applying, be ready to provide proof of income, such as pay stubs, tax returns, or bank statements. A higher income can also increase your credit limit.

Lower Your Debt-to-Income Ratio

Lenders consider your debt-to-income ratio (DTI) when reviewing your application. A high DTI means you have more debt compared to your income, which can make lenders hesitant to approve you.

Paying down existing debts before applying for a new credit card can improve your DTI and increase your chances of approval.

Use Your Credit Card Responsibly

Once you’re approved for a credit card, responsible use is essential for improving your credit score. Follow these best practices:

-

Pay your bill on time every month to avoid late fees and negative marks on your credit report.

-

Keep your credit utilization low by using less than 30% of your available credit.

-

Avoid maxing out your card, as high balances can hurt your score.

-

Monitor your credit report regularly to track your progress.

Final Thoughts

Applying for a credit card with bad credit can be challenging, but it’s not impossible. By understanding your credit score, choosing the right card, and following responsible credit habits, you can increase your chances of approval and improve your financial future.

With patience and smart financial management, you can rebuild your credit and qualify for better credit opportunities in the future.