The right software can save you time and money while maximizing deductions. Whether you’re self-employed, a freelancer, or a small business owner, choosing the best tax preparation tool is essential. We’ve rounded up the top tax software programs for 2025, considering factors like affordability, ease of use, expert support, and accuracy guarantees.

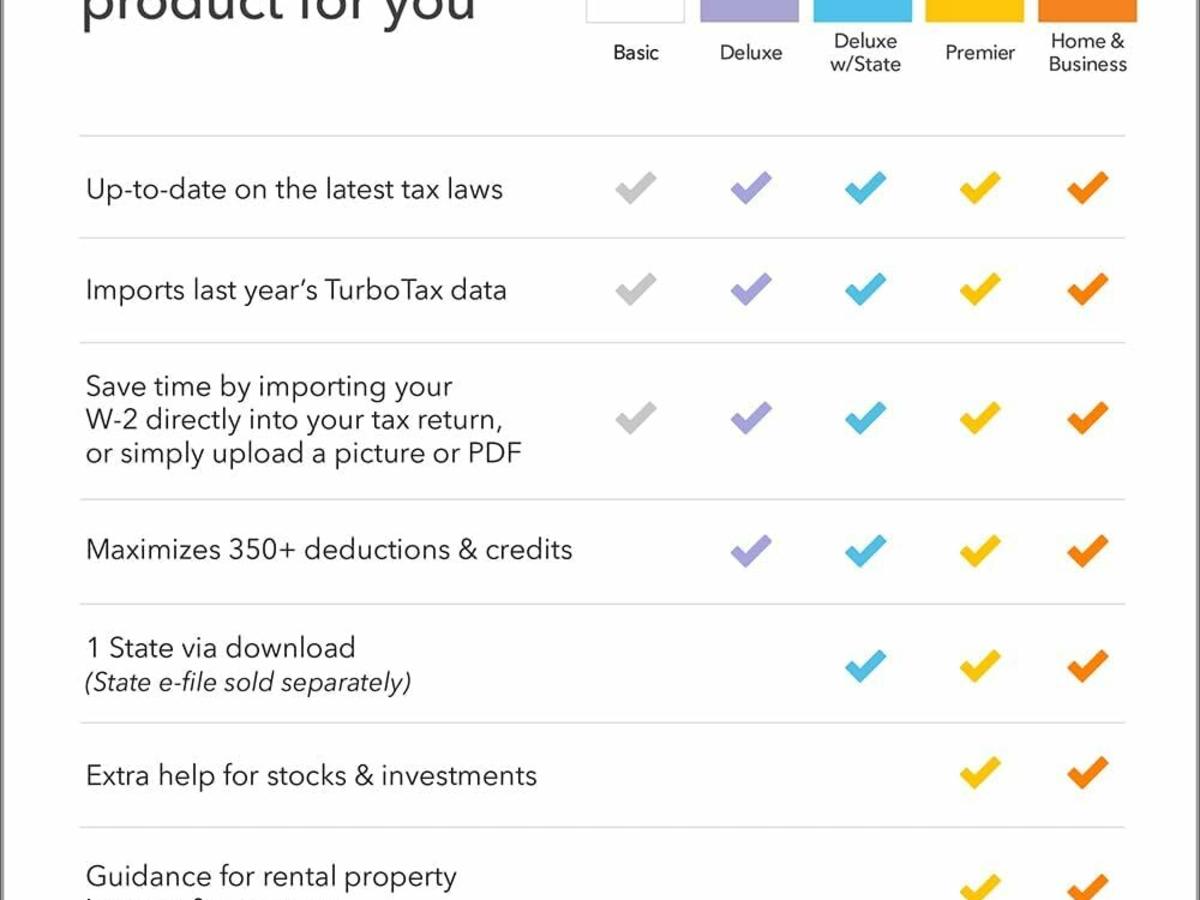

Best for Ease of Use: TurboTax Premium

TurboTax Premium stands out for its user-friendly interface and step-by-step guidance. Its intuitive question-and-answer format makes tax filing simple, even for those with no prior experience.

Key Features:

- Step-by-step guidance through a Q&A format

- TurboTax Live provides on-demand tax advice from experts

- Full-Service Option allows a tax professional to file your return for you

- Accuracy & Maximum Refund Guarantee

- Audit Support to help with IRS inquiries

Pros:

- Easy-to-follow interface

- Offers live expert help (for an additional cost)

- Guarantees accuracy and maximum refunds

- Provides audit assistance

Cons:

- More expensive than some alternatives

- Live expert assistance costs extra

TurboTax is an excellent choice for small business owners who want a simple, guided filing experience with expert support.

Best for Support Options: H&R Block

H&R Block is ideal for business owners who want multiple support options, including online assistance and in-person consultations at physical locations.

Key Features:

- Step-by-step guidance with an easy-to-use platform

- Unlimited chat and video support with the Online Assist plan

- Access to tax professionals with an average of 10 years of experience

- Over 11,000 physical locations for in-person help

- Maximum Refund and Accuracy Guarantee

Pros:

- User-friendly, even for beginners

- Live chat and video support available

- Access to in-person tax professionals

- Provides audit assistance

Cons:

- Plans with live expert support are more expensive

- Costs are slightly higher than some competitors

If you prefer the flexibility of both online and in-person support, H&R Block is a great option.

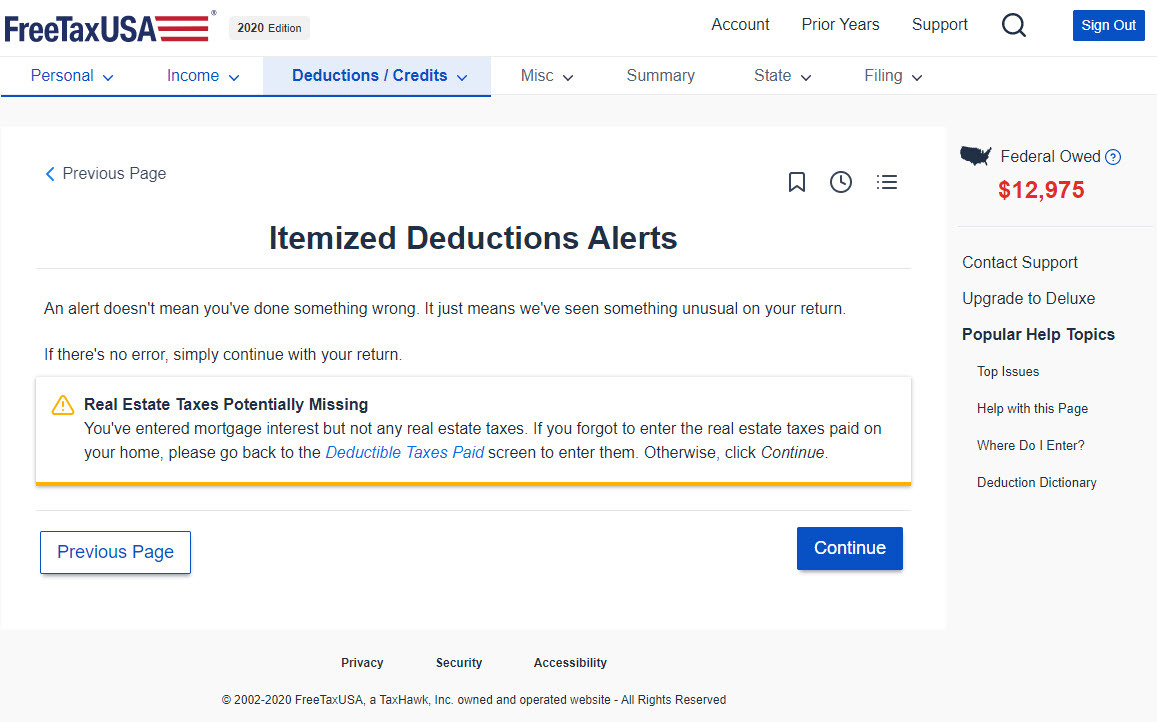

Best Free Tax Software: FreeTaxUSA

If you’re looking for an affordable way to file your business taxes, FreeTaxUSA is an excellent option. While federal filing is free, state filing comes with a minimal fee.

Key Features:

- Free federal tax filing

- Affordable state tax filing at just $14.99

- Audit defense with the Deluxe edition

- Maximum Refund Guarantee

- 100% Accuracy Guarantee

Pros:

- Free federal filing

- Low-cost state filing ($14.99)

- Audit support available with an upgrade

- Maximum refund and accuracy guarantees

Cons:

- No W-2 import feature – you must manually enter information

- Live chat support requires a Deluxe upgrade

For small business owners looking to file taxes at little to no cost, FreeTaxUSA is a budget-friendly choice.

Best Affordable Option: TaxSlayer Self-Employed

TaxSlayer offers competitive pricing, making it a great option for cost-conscious business owners. Despite its affordability, it still provides access to tax experts.

Key Features:

- Lower-cost plans than many competitors

- Low-cost state filing fees

- One-on-one support with tax professionals

- Accuracy and Maximum Refund Guarantee

- IRS audit support

Pros:

- Affordable pricing for self-employed individuals

- Includes access to tax professionals

- Provides IRS inquiry and audit support

- 100% accuracy guarantee

Cons:

- Must use a discount code for the best pricing

If you’re looking for an affordable tax preparation software with expert support, TaxSlayer Self-Employed is a great option.

Best for Accuracy Guarantee: TaxAct

TaxAct provides one of the strongest accuracy guarantees, covering potential penalties and interest if a calculation error occurs.

Key Features:

- Up to $100,000 Accuracy Guarantee

- Maximum Refund Guarantee

- Affordable pricing compared to competitors

- Expert tax support available (for an extra fee)

Pros:

- Strong accuracy guarantee (up to $100,000)

- More affordable than other paid software

- Offers one-on-one tax expert support

Cons:

- Higher cost for self-employed plans with expert help

If you want the best accuracy protection, TaxAct is a reliable choice.

Best for Automatic Tax Planning: Found

If you’re a freelancer or independent contractor looking for a tax preparation tool that also handles bookkeeping, Found is a top pick.

Key Features:

- Automatic tax form generation

- Auto savings for estimated taxes

- Real-time expense and income tracking

- Built-in bookkeeping tools

- 30-day free trial for Found Plus

- Integration with QuickBooks, PayPal, Stripe, and more

Pros:

- Free version includes tax estimates and write-off tracking

- Auto-saves funds for estimated tax payments

- Integrates with popular financial apps

- Generates profit-and-loss reports

Cons:

- Business tax filing is only included in the Found Plus annual plan

If you want a tax preparation tool that also manages your business finances, Found is an excellent choice.

Final Thoughts

The best tax preparation software for small businesses depends on your needs and budget.

- If you want an easy-to-use platform with expert support, go for TurboTax Premium.

- If you prefer in-person help, H&R Block is a great choice.

- For a free option, FreeTaxUSA is hard to beat.

- Budget-conscious business owners will appreciate TaxSlayer’s affordability.

- If accuracy guarantees matter most, TaxAct is the way to go.

- For automatic tax planning and bookkeeping, Found is the best option.

By selecting the right software, you can streamline tax filing and focus on growing your business.